All About Medigap Benefits

Rumored Buzz on Medigap Benefits

Table of Contents8 Simple Techniques For What Is MedigapThe Greatest Guide To Medigap BenefitsThe Main Principles Of How Does Medigap Works The Facts About Medigap Benefits UncoveredThe Ultimate Guide To Medigap

You will need to speak to a qualified Medicare representative for prices and schedule. It is very suggested that you buy a Medigap policy throughout your six-month Medigap open enrollment duration which starts the month you turn 65 and are enrolled in Medicare Part B (Medical Insurance Coverage) - How does Medigap works. Throughout that time, you can acquire any kind of Medigap policy marketed in your state, even if you have pre-existing problems.You may need to purchase an extra pricey policy later on, or you might not have the ability to purchase a Medigap policy at all. There is no assurance an insurance company will certainly market you Medigap if you make an application for coverage outside your open registration period. Once you have actually decided which Medigap strategy meets your demands, it's time to discover which insurance provider sell Medigap policies in your state.

The specific insurance coverages depend on the type of strategy that is purchased and which specify you live in.

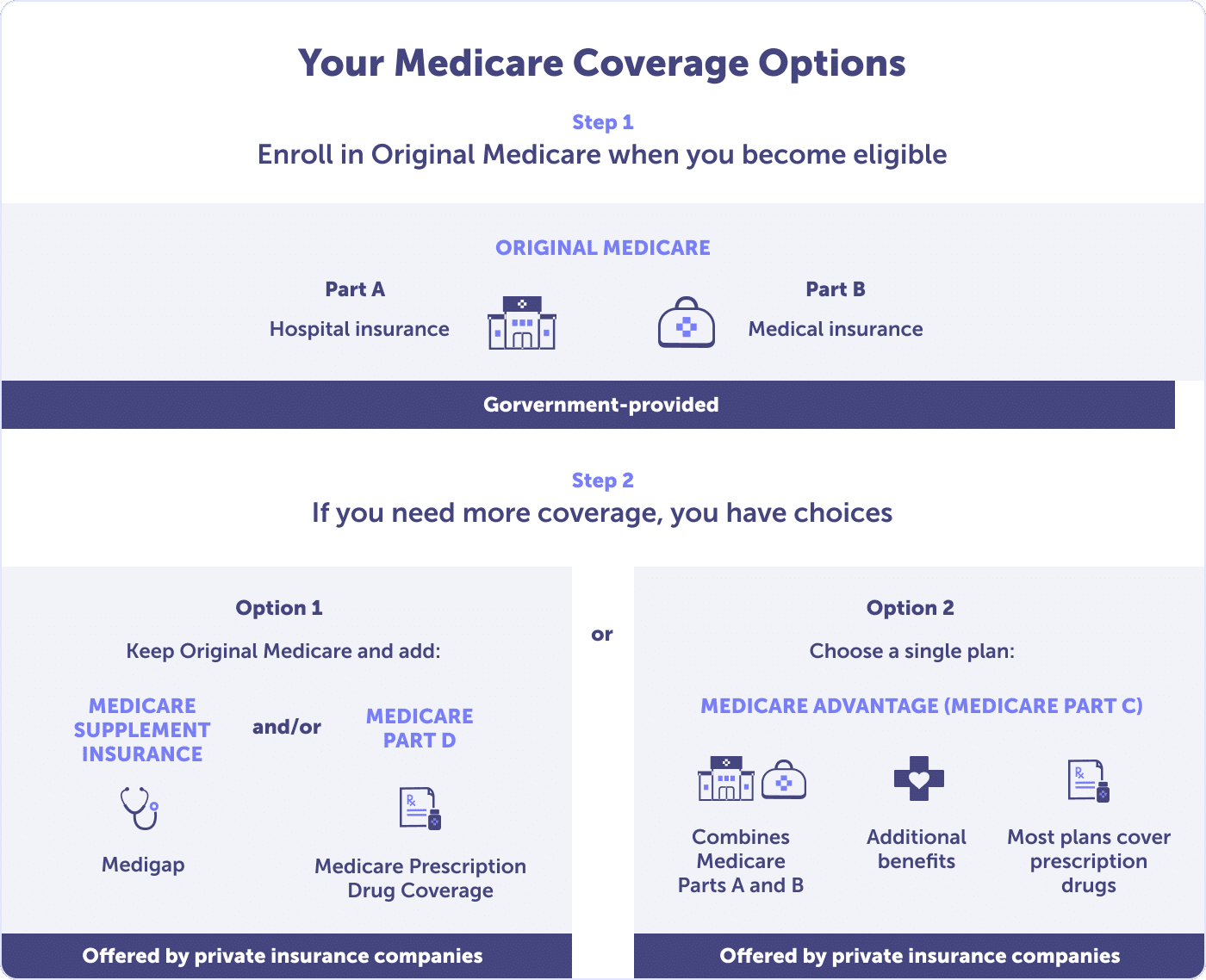

As a whole, Medigap insurance firms collaborate with Initial Medicare and also each plan kind offers the same benefits, even throughout insurance companies. In many states, Medicare supplement strategies are named A through N. Tabulation, Expand, Collapse When considering Medigap plans, you may also check out Medicare Advantage plans Called Medicare Part C.

Medicare supplement insurance, on the other handVarious other is an addition to enhancement existing Original Medicare initial. Remember that Medigap policies only can be incorporated with Original Medicare and not Medicare Benefit. Medigap plans are standardized and also identified by letters, as well as have to follow federal and state guidelines. Usual Medigap coverages consist of: This is an out-of-pocket expense that people must pay each time they receive healthcare or a clinical item, such as a prescription.

This is the percent of the cost of a solution that you share with Medicare. Medigap benefits. With Part B, Medicare typically pays 80% and also the patient pays 20%. This is the amount of cash the individual must pay of pocket for medical care prior to Medicare starts spending for the expenses. With Part A, there's a deductible that uses to each benefit period for inpatient care in a healthcare facility setup.

Little Known Questions About How Does Medigap Works.

If you require medical care solutions while traveling outside of the USA, it's crucial to understand that Original Medicare does not cover emergency situation healthcare solutions or materials outside of the united state However, there are some points that Medicare supplement insurance policy typically does not cover, such as vision or oral treatment, glasses, hearing aids, private-duty nursing, or lasting care.

Medigap prepares can assist you reduce your out-of-pocket health care costs so you can obtain affordable therapy for extensive medical care throughout your retired life years. Medicare supplement plans may not be right for each situation, but understanding your alternatives will aid you determine whether this type of coverage could help you manage medical care costs.

Reporter Philip Moeller is right here to provide the answers you require on aging and retired life. His regular column, "Ask Phil," aims to assist older Americans as well as their households by addressing their wellness treatment and also economic concerns.

The Of What Is Medigap

The largest gap is that Part B of Medicare pays only 80 percent of protected costs. Probably, even more people would buy Medigap plans if they can afford the regular monthly premiums. Nearly two-thirds of Medicare enrollees have standard Medicare, with about 35 percent of enrollees rather picking Medicare Benefit plans.

Unlike other exclusive Medicare insurance coverage plans, Medigap strategies are managed by the states. As well as while the certain protection in the 11 different kinds of strategies are determined by federal rules, the rates and also schedule of the plans rely on state regulations. Federal guidelines do supply guaranteed issue rights for Medigap purchasers when they are new to Medicare as well as in some circumstances when they switch between Medicare Advantage more and also basic Medicare.

However, once the six-month period of government mandated legal rights has actually passed, state regulations take control of determining the civil liberties individuals have if they wish to buy new Medigap strategies. Right here, the Kaiser table of state-by-state policies is indispensable. It needs to be an obligatory stop for anybody thinking of the duty of Medigap in their Medicare plans.

Rumored Buzz on How Does Medigap Works

I have not seen difficult data on such conversion experiences, and routinely inform viewers to check the market for new policies in their state before they switch over right into or out of a Medigap plan during open registration. I think that fear of a possible problem makes numerous Medigap policyholders resistant to alter.

A Medicare Select plan is a Medicare Supplement policy (Strategy A with N) that conditions the payment of benefits, in entire or in part, on making use of network service providers. Network companies are providers of wellness treatment which have gotten in into a written agreement with an insurer to offer benefits under a Medicare Select plan.